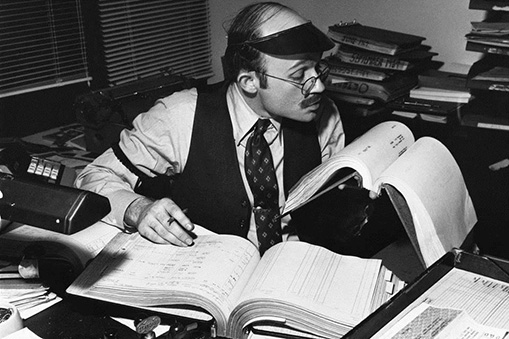

What do you think of when we say “accountant”? Is it this guy?

It might be natural to assume that a degree in accounting essentially equates to a lifetime of number-crunching and spreadsheets. But it’s not that, not anymore. More likely, it’s this:

So why should you pursue accounting?

Few other careers open up this many potential options for employment — you may find yourself at the federal government, small or mid-sized companies or the biggest businesses in the world, non-profit organizations or even your own firm. One website gives examples of heroic FBI investigators, worldwide-scheme-unraveling auditors, and high-rolling celebrity financial advisors … all accountants!

Those high-profile gigs may be few and far between, but it is absolutely true that accounting isn’t what it used to be, and more than ever, the business world needs effective accountants. As regulations and tax laws change and evolve, the global economy is more complex than ever.

And it’s not just businesses; there are millions of folks planning for retirement, starting up something innovative, passing their small business on to their children or trying to keep their ministry accounts in order. All this means higher demand for accountants and more ways to pursue accounting as a career.

But you might have some ideas about what being an accountant is like — from movies, TV or the internet — that are just not correct. Here’s five of the most common myths:

Myth #1: It’s all about math…and I’m not crazy about math!

No, it’s not all about math. As Crowell accounting professor Randy Markley says: “We use math, but it’s much more than that — it’s puzzle-solving. We use the formulas, but it's not really about them, either — it's about concepts and terms — and once you understand those, even the math becomes fun.”

It’s about teamwork. In your first job, you're likely to start as a staff accountant on a team responsible for preparing financial statements or auditing a particular account or a client's financial statements. So people skills, including leadership and interpersonal communication, are crucial.

It’s about other kinds of communication, too. If you're a public accountant, you may spend a significant amount of time face-to-face with clients, providing individualized solutions to their unique tax and accounting issues. You will likely do presentations and write reports for your colleagues, your bosses, or even the board of your company, so those kinds of communication skills are also important. And let’s not forget project management, problem-solving, critical thinking, and professional skepticism!

It’s also about continuing to learn. Accountants today (and tomorrow!) will have to constantly adapt and learn new skills. So it’s certainly not about math, at least not primarily — rather, the ability to think critically and problem-solve, to communicate and cooperate with other people, and the ability and willingness to keep learning are what you need.

Myth #2: There are more accountants than jobs, so it’ll be hard to find work!

Not true at all! There is actually a documented shortage of accountants right now that is projected to get worse. The NPR podcast “Planet Money” noted that “there's a downward trend in both the number of accounting graduates and people taking the CPA exam, and this is coming just as the industry really needs CPAs because of retiring baby boomers. The American Institute of CPAs estimates that three-quarters of its members hit retirement age in 2020.” The number of accounting graduates in 2018 dropped nearly 7% since peaking in 2012, according to a 2019 report from the American Institute of CPAs, the most recent data available.

On top of that, accounting-related needs are projected to grow in the coming years. The Bureau of Labor Statistics (BLS) projects employment of accountants and financial auditors to grow seven percent from 2020 to 2030, which amounts to 96,000new jobs, in addition to replacing ten of thousands of retiring accountants.

Myth #3: I can’t make any money as an accountant!

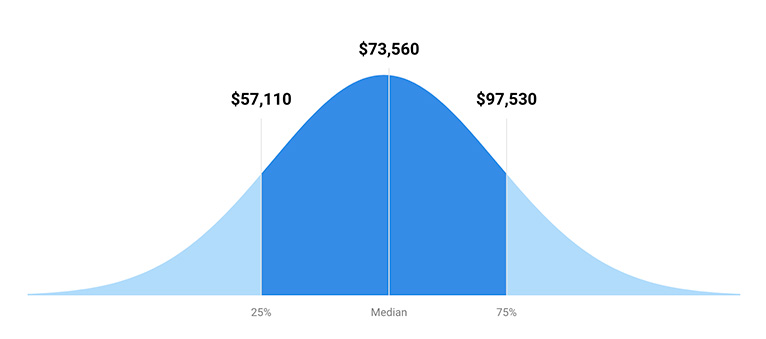

Accountants make good money, with even entry-level accounting professionals earning a well-above-average salary. Given the specialized knowledge required and the essential nature of the work, most businesses recognize that they need to pay their accountants well.

The shortage of accountants has prompted many larger firms to boost both salaries and benefits. The median salary for accountants and auditors in 2021 was $77,250, a 5% increase over 2020 and well above the 2021 median salary for all workers of $45,760. That earning potential increases for those who are able to advance into management roles — the Bureau of Labor Statistics reports the 2021 median salary for financial managers was $131,710.

We hope that, for Biola students, it’s not all about money — but it’s still a factor.

Myth #4: Accountants get stuck in closet-sized cubicles in giant downtown skyscrapers that require a two-hour commute — each way!

Okay now, take a breath there. Even with the across-the-board shift toward remote and hybrid work, there are few careers that are more universally-needed — and thus “can-go-anywhere” — than accounting.

Everyone everywhere needs accountants, from farmers to government organizations to software development companies. With remote-work options, you can live near a city, or live in a forest near a mountain stream, or lots of places in between. This gives accountants a remarkable amount of flexibility when it comes to choosing where they want to be.

Now, working remotely does have its challenges. If you’re easily distracted or tend to let things slide, doing accounting remotely is probably not for you. Accountants must be conscientious and even tend toward perfectionism. The decisions involved may be worth millions of dollars, so your details, figures and conclusions must be accurate.

Myth #5: It’s just moving numbers around. I want to make a real impact in business!

Accountants solve real business problems. You will use your knowledge to provide accurate data that will drive decision-making. You will ensure the financial integrity of your company. You will work in partnership with others, using your data-driven insights to help drive success. And becoming a trusted business advisor will very likely give you the opportunity to eventually lead other departments and sit at the table for mergers, strategic planning and board meetings.

“Accounting is the language of business and you have to be as comfortable with that as you are with your own native language to really evaluate businesses,” said billionaire investor Warren Buffett. So perhaps it’s time to learn the language?

Sources

- Accounting Today: Building a Career

- CPA Journal: A Variety of Opportunities

- Monster.com: Myths Vs. Realities

Learn more or apply to Biola’s B.S. in Accounting degree or Master of Professional Accountancy (MPAcc) degree.

Biola University

Biola University

.jpg)

.jpg)